Luckin Coffee vs Starbucks: A Luckin Success in China

There’s a new coffee shop chain in China, called Luckin Coffee, and it’s been fascinating to watch their rise on the local market. I know from my own observations that the Chinese in the big cities love their coffee. I’m also aware the current stats on coffee consumption per nation says that the average person in China drinks only 3 coffees per year. However, that is changing *rapidly*.

A Starbucks on every block

I’ve been coming to China for more than 20 years, and in the last several years I have been shocked at how many Starbucks shops there are. They are always really busy which shocks me, especially since they charge the Chinese more $ for a coffee than I see in Australia and the USA. It seems like they’re on all four corners of every block. The popularity of Starbucks here is incredible, especially coming from Australia where Starbucks was an out and out failure. In Australia, Starbucks arrived with a bang, and then fizzled out – the few stores that remain are only in the touristy areas, catering to international visitors who want a taste of the familiar.

The difference for Australia is we have a long and robust history of independent coffee culture (thanks to the Italians and Greeks), so we don’t need Starbucks. But in China, both the price and quality of what’s available at independent coffee shops is very inconsistent, so Starbucks is loved for its consistency.

It’s hard to understand how packed a Starbucks can get, with everybody touching each other with laptops out. It’s the hip place for everyone, especially startup entrepreneurs, to meet up and work.

The only other coffee chain I’ve seen in years gone by was Costa Coffee (it’s not well known in Australia, but they’re actually the 2nd biggest selling coffee chain in the world) – and in China they have been running a very remote second, with around 449 stores. Last week I visited a technology campus, Shangdi Science Park, in Beijing, where I learned that until last year, they had 1 Starbucks shop and 1 Costa Coffee shop. Now, just 1 year on, the park has 2 Luckin Coffees and the Costa has gone!

Enter Luckin Coffee

To my western mind, the name looks like something starting with F but it actually means “rich and lucky” – which is very apt given how their business is booming. In the last year, the Luckin Coffee presence has gone crazy. They’re the new kid on the block, and in just *1 year*, they feel to be everywhere. There are nearly 2,000 stores in 30 cities. Their biggest competitor, Starbucks, has 3,300 stores in China across 140 cities. However, that took time – Starbucks has been in China for nearly 20 years – and it took them 12 years to achieve what Luckin has done in just 1.

Starbucks’s success has paved the way for coffee culture in China to flourish and therefore created a booming market. It hadn’t occurred to me that they were vulnerable to competition.

The battle for market share

We’ve already seen what happened when the Chinese ridesharing company, Didi, went head to head for several years with international giant Uber – and won. This was a different battle though. Didi got its start in China in 2012, whereas Uber came to China after, in 2013. What followed was a brutal 3-year battle for market share, costing both parties billions, which ended in 2016, when Uber gave up and let Didi buy them out. It was a fascinating case study of how the Chinese market works and illustrated principles of how important it is to understand the local market.

Didi did a lot of things right, and Uber made a lot of mistakes. For example, we think the Uber app is awesome – but Didi’s app was awesome first. They understood the way modern China works and their success was in the app, the gamification, and the payments.

With Starbucks vs. Luckin, I expect we’ll see many of the same strategies used in the ridesharing wars:

- Steep discounting

- Heavy advertising targeting the Chinese middle class

- Sweeteners and gamification like loyalty freebies, bulk purchase freebies, and freebies for getting friends to sign up for the app, etc.

For example, the guys in my office got their first Luckin coffee for free, they got half a dozen friends to sign up so they got another 6 coffees for free, and with the simple delivery, it wasn’t long before they were hooked.

Points of difference: The app

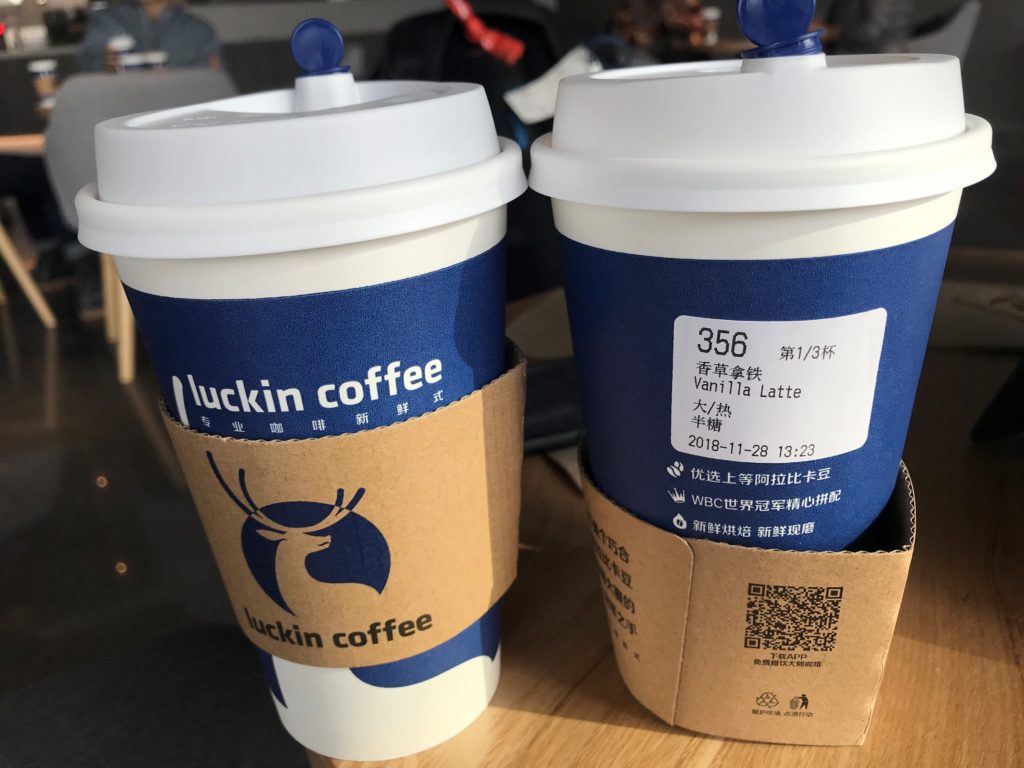

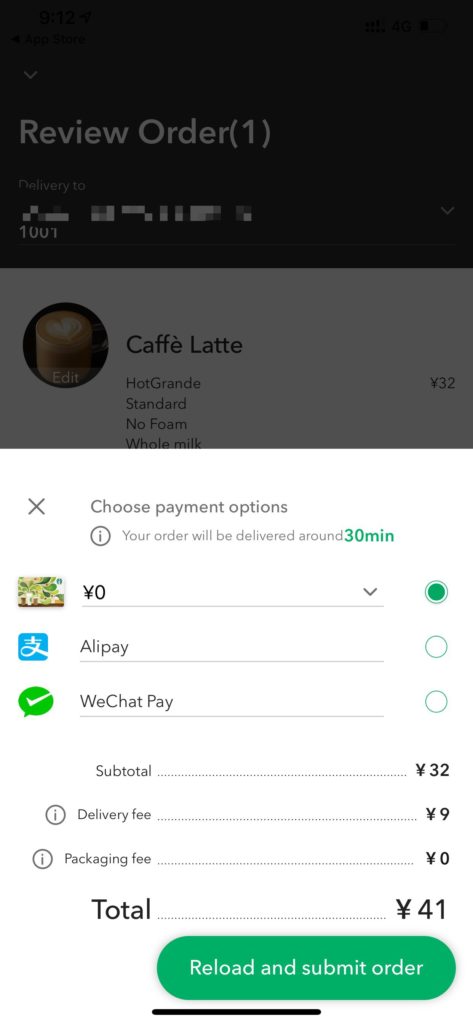

In China, mobile apps are huge. In the US, less than 1 in 10 Starbucks orders are made via the app, and for Starbucks China, ordering via the app is optional. You can still order the traditional way and pay with cash. Luckin Coffee shops, on the other hand, are entirely cash-free and have a very “Apple store” feel, without a till. Your experience ordering a coffee is the same, in or out of the store. You look down at your phone, make a couple of taps, and you continue your conversation. Ordering and payment is all done directly via the Luckin app. If you’re in the store, you don’t even have to speak to anyone – the app gives you a notification that your coffee is ready. See the photo.

Points of difference: Delivery

In modern China, having a delivery option is an expected part of the food and drink industry, and Luckin has offered delivery from the beginning. In fact, nearly half of all Luckin stores are “delivery kitchens”, designed exclusively for fulfilling orders made online and delivering them out of store. Conversely, Starbucks was slow to offer delivery – it wasn’t until August of this year that it became something they offered directly. Before that, if you wanted delivery, you had to use a 3rd party service, and all Starbucks stores are still set up cafe-style. To be fair, the ele.me app (meaning “are you hungry?”) which has been going strong delivering Stabucks for 2 years – was – and still is – the mainstream way to get your coffee delivered.

When I asked the guys in the SSW Hangzhou office what they thought of the Starbucks delivery system, they told me they didn’t even realize Starbucks offered its own delivery… and when they looked at the delivery price they pay today through ele.me versus the official Starbucks app, they weren’t impressed with the delivery fee.

Points of difference: Price

Another point of difference between the competitors is price: I was amazed when I realised that Starbucks costs more in China than in Australia or the USA. For reference, a “tall” brewed coffee in the USA costs between $US1.95 and $US2.15, whereas in China, the same drink can cost more than US$6.

In America, the average salary buys 1,000 lattes a month, but in Beijing the average earner can only afford 200, a fact which caused social media outrage when it was noticed in 2013. On the other hand, Luckin’s prices are up to 30% cheaper than Starbucks China. Costa Coffee is also cheaper than Starbucks, but not by much.

Points of difference: Branding

In China, if you want to be super cool, you have an iPhone. If you want “normal cool”, you have a Mi phone. Likewise, if you’re drinking coffee, you’re already hip. If you’re drinking Starbucks, you’re super cool. If you’re “normal cool”, you’ll go to Luckin Coffee.

If you’ve got a sharp eye for fonts, you’ll notice that the Luckin font is the same as a certain blue-themed social media platform that is banned in China (also starting with F… Facebook!). The absence of Chinese characters in the logo is likely deliberate because Western brands carry – especially to do with food and drink – an idea of quality and safety.

Technical note: The font name used by Facebook and Luckin is Klavika Bold Bold.

The future

I would attribute Luckin’s current success to the way it meshes trends in China’s booming tech industry with the established coffee-shop model, and its lower price point. However, Starbucks in China is making strides to attempt to catch up and stay current within the rapidly-evolving Chinese market. They’re taking some of the good stuff from Luckin, such as official delivery, delivery kitchens, and changes to their app (for gamification).

Starbucks is currently top dog in China but will have to fight to stay there in the face of serious new competition. Costa Coffee will also be a renewed threat as they are going to be purchased by Coca-Cola in 2019, but I believe that of these 3 competitors, Luckin Coffee is growing the fastest. I know they’re not currently even in the top 10 largest coffee houses worldwide, but I predict they will add English support to their app, expand overseas, and make it into the top 10 within 3 years and keep climbing up the ladder.

I also expect them to have a whole lot of problems with such rapid growth. Induction systems can’t solve everything and without organic growth, they don’t have employees learning from other employees. Every mistake Luckin make will be put on social media and it will hurt.

Luckin is cheaper, tech-savvy, and they’re doing things smarter for the Chinese market. Even if it doesn’t take over the top spot, the tales of these 2 competitors both make great case studies: Starbucks is a great case study of how to break into the Chinese market (and charge even more $ than Aussies and Americans pay for coffee!), and Luckin is a great case study of how to disrupt the status quo – and quickly.

Coffee in China has never been more affordable, popular, or ubiquitous. I’ll be curious to see how that figure of “3 coffees per person per year” climbs in the next few years.

The whole “Chinafy” thing we encourage at SSW, is about learning and understanding the culture in China so that businesses know how to take advantage of an untapped market. I’ve been working with Lindsay on Chinafy, and he is joining me here in Hangzhou this week. We’re going to go for coffee – I can’t wait to see if he wants to go for the ol’ fashioned Starbucks or the trendy Luckin.

Summing Up Video

I’d love to hear your opinion:

- Do you enjoy the experience of Starbucks more?

- Do you guess Starbucks use different milk? (Foreign milk)

- Do your friends buy coffees from Luckin?

- Do you care that Luckin is Chinese (not American)?

- What city are you in?

2021 Update!

Fast forward to 2021, and it looks like Luckin Coffee is still going strong despite filing for bankruptcy, and openly admitting to fraudulently overinflated their profits by more than 88%! Despite this, they continue to operate with many people still drawn in by the A$3 coffee. For comparison, a Starbucks coffee is around A$7 a coffee – which is a huge difference! I wonder how long can they continue to operate?

Watch this video from the Wallstreet Millennial for more: https://www.youtube.com/watch?v=KnqQPWD4FJc.

January 3, 2019 @ 5:09 PM

It’s interesting. Your post never mentions about the difference in taste/quality of the two, which in my opinion is also one of the most important items.

January 10, 2019 @ 12:43 AM

Great post, thanks. I am working in the coffee business (Italian espresso) and what’s happening right now in China is impressive. I visit the country from time to time and it’s awesome to see such a fast developing market especially compared to ours.

Luckin Coffee vince perché capisce il mercato cinese – odello.me

January 17, 2019 @ 8:12 AM

(Italian Blog) Luckin Coffee wins because it understands the Chinese market

The Chinese have a different idea of what the service is and reward the brands that respect it

————————————————————————-

[…] che hanno a che fare moltissimo con la cultura cinese (e ne parla con grande dovizia di particolari Adam Cogan): pagamento su app, tempi di servizio rapidi (molto più veloci di Starbucks) e, soprattutto, […]

China: Coming to a Town Near You - Adam Cogan

April 5, 2019 @ 7:36 AM

[…] service DiDi in the Australian market. I previously mentioned DiDi in my recent blog post, “Luckin Coffee vs. Starbucks“, but if you missed it, Didi is a ridesharing service similar to […]

SSW had fun at NDC – gotta catch 'em all! - Adam Cogan

November 6, 2019 @ 12:21 AM

[…] my 3 months in China with Ruby last year, we got addicted to using QR codes. I wanted to build a mobile app that did something fun with QR […]

January 2, 2020 @ 8:52 AM

Also interesting on the coffee production side, now Yunnan is becoming a major coffee production center, see https://coffee-facts.com/culture/coffee-and-china-changing-the-geopolitics-of-coffee/